mentalnutritioncentre.ru

Community

Average Ira

In , the median was $, in retirement savings for Baby Boomers and $69, for members of Generation X, according to the Transamerica Center for. While the average (mean) and median IRA individual balance in were Furthermore, the typical working household has virtually no retirement savings - the. That means the average retirement account at age 67 should be $,, based on Fidelity's guidelines. READ: If You Want to Retire in , Here's What You. How Much Will You Receive in Retirement? Look at your highest average salary (HAS) table to find out when you can retire and how much you will receive in. The average retired worker gets $1, a month as of December If you have a lot of debt that you can't pay off before you retire, or you want to travel. Normal Retirement (Unreduced Benefit). Normal retirement, also known as superannuation or full retirement, is an unreduced DB benefit where all age and/or. Learn the average retirement savings by age and how it stacks up to what the experts recommend. average worker's wages during retirement. For more information about traditional IRAs or Roth IRAs, please visit our IRA Calculator or Roth IRA Calculator. Further, our research suggests that, on average, spending decreases in retirement. It doesn't stay constant (adjusted for inflation) as suggested by the 4% rule. In , the median was $, in retirement savings for Baby Boomers and $69, for members of Generation X, according to the Transamerica Center for. While the average (mean) and median IRA individual balance in were Furthermore, the typical working household has virtually no retirement savings - the. That means the average retirement account at age 67 should be $,, based on Fidelity's guidelines. READ: If You Want to Retire in , Here's What You. How Much Will You Receive in Retirement? Look at your highest average salary (HAS) table to find out when you can retire and how much you will receive in. The average retired worker gets $1, a month as of December If you have a lot of debt that you can't pay off before you retire, or you want to travel. Normal Retirement (Unreduced Benefit). Normal retirement, also known as superannuation or full retirement, is an unreduced DB benefit where all age and/or. Learn the average retirement savings by age and how it stacks up to what the experts recommend. average worker's wages during retirement. For more information about traditional IRAs or Roth IRAs, please visit our IRA Calculator or Roth IRA Calculator. Further, our research suggests that, on average, spending decreases in retirement. It doesn't stay constant (adjusted for inflation) as suggested by the 4% rule.

From January 1, to December 31st , the average annual compounded rate of return for the S&P ®, including reinvestment of dividends, was. Managers maintain the current target mix, freeing you from the hassle of ongoing rebalancing. Low costs. The average Vanguard Target Retirement Fund expense. Average monthly DCP contributions by age. You can roll over certain distributions into DCP from a former employer's retirement plan or a non-Roth IRA. With our IRA calculators, you can determine potential tax implications, calculate IRA growth, and ultimately estimate how much you can save for retirement. The average balance in traditional IRAs ($,) is much larger than that in Roth IRAs ($52,). Traditional IRA owners with adjusted gross income above. The above chart shows that U.S. residents 35 and under have an average of $49, in retirement savings; those 35 to 44 have an average $,; those 45 to. Discover the average retirement income to determine where you might fall and what makes a good retirement income. This calculator estimates how long your savings can last at a given withdrawal rate. The amount you have. You plan to withdraw. /month. Average investment. Your IPERS retirement benefit is guaranteed because it is calculated with a formula that includes your age, average salary and years of work in IPERS-covered. Retirement Eligibility and Average Monthly Compensation. Members can retire with a lifetime benefit as early as age 50 once they have acquired 5 years of. traditional IRA to the Roth IRA. If you're under age 59½ and you have one Industry average expense ratio: %. All averages are asset-weighted. Hawaii has the highest annual cost for retirement, with an average of $, needed in retirement savings each year to pay for groceries, housing. This calculator will show you the average number of additional years a person can expect to live, based only on the sex and date of birth you enter. IRAs · Investment accounts. Financial tools. Financial tools. Dashboard Tools Data presented represent the average (mean) balances of retirement. With our IRA calculators, you can determine potential tax implications, calculate IRA growth, and ultimately estimate how much you can save for retirement. typical target date retirement fund, a 15% savings rate, a % constant real wage growth, a retirement age of 67 and a planning age through The. The second is Social Security, which on average could replace up to 40 percent of your pre-retirement income. (IRA), your contributions can be fully or. Over 95% of our Retirement Funds with a year track record beat their year Lipper average as of 6/30/ Browse Retirement Funds >. Best IRA accounts · Best Roth IRA accounts Overview: You don't have a lot to choose from when it comes to ETFs tracking the Dow Jones Industrial Average. Using assumptions about average annual raises (2%), investment performance before and after retirement (7% and 4%, respectively), inflation (2%) and retirement.

What Will A Recession Do To The Housing Market

What does a recession mean for the real estate market? · Recessions impact the real estate market, often drastically. · The most severe negative case scenario is. A housing market crash after a recession is the worst possibility for anyone looking to buy or sell a home. An example of this scenario is the housing crash of. Housing prices don't decrease due to interest rates necessarily. Appreciation value decrease, meaning home prices do not gain as much value. You don't need to fear what a recession means for the housing market. If we do have a recession, experts say it will be mild and short, and history shows it. Assuming we are in a recession now, just take a look at the housing market. I think prices will flatten out, and maybe even decrease a bit. Two proximate causes were the rise in subprime lending and the increase in housing speculation. Investors, even those with "prime", or low-risk, credit ratings. According to economic experts, home values will decline by %, which is the range by which property values often decline during recessions. Why Do House. In most recessions, many marginal prospective buyers drop out of the market because their incomes have gone down, and an unusual number of. In short, if you are buying on, a recession matters less than people think. For first-time buyers, however, things can be a little bit trickier and you may. What does a recession mean for the real estate market? · Recessions impact the real estate market, often drastically. · The most severe negative case scenario is. A housing market crash after a recession is the worst possibility for anyone looking to buy or sell a home. An example of this scenario is the housing crash of. Housing prices don't decrease due to interest rates necessarily. Appreciation value decrease, meaning home prices do not gain as much value. You don't need to fear what a recession means for the housing market. If we do have a recession, experts say it will be mild and short, and history shows it. Assuming we are in a recession now, just take a look at the housing market. I think prices will flatten out, and maybe even decrease a bit. Two proximate causes were the rise in subprime lending and the increase in housing speculation. Investors, even those with "prime", or low-risk, credit ratings. According to economic experts, home values will decline by %, which is the range by which property values often decline during recessions. Why Do House. In most recessions, many marginal prospective buyers drop out of the market because their incomes have gone down, and an unusual number of. In short, if you are buying on, a recession matters less than people think. For first-time buyers, however, things can be a little bit trickier and you may.

The housing market changes during the recession, and those who do want to buy a home will find fewer offers but also less competition. Therefore, they will. Although the housing market does open up during an economic downturn, this is a time of economic unpredictability, and people become hesitant. Consumer spending. According to ATTOM data, I found that there have been five recessions since , and house prices fell only twice during the recession ( A recession will put upward pressure on lending rates that should dramatically reduce the demand for homes. This, by definition, should cool home prices. However, housing economists agree that it will not crash: Even if prices do fall, the decline will not be as severe as the one experienced during the Great. If the housing market crashes, interest rates are likely to go up. Higher interest rates reduce demand for housing because the cost of. A recession isn't the ideal moment to sell a property. It's best to do so before a recession hits if you can anticipate when that may be. Nobel Prize-winning. In most recessions, many marginal prospective buyers drop out of the market because their incomes have gone down, and an unusual number of. How Does a Housing Recession Affect the Housing Market? Housing recessions usually depress the prices of the real estate markets. The bad economic condition. How Does a Recession Affect Realtors? Real estate markets tend to suffer during recessions, due to higher interest rates and lower overall spending power. As. In the worst-case scenario, house prices may crash about 25 percent, in real terms, in a recession. · The Impact of a recession on house prices, in real terms. During economic recessions, house prices tend to go down. The reason is quite simple; personal income is one of the most significant factors driving home. “Over the past five recessions, mortgage rates have fallen an average of percentage points from the peak seen during the recession to the trough. And in. The bank expects worsened affordability in the near term as mortgage rates remain elevated, which will in turn weaken housing activity. Home prices will. You don't need to fear what a recession means for the housing market. If we do have a recession, experts say it will be mild and short, and history shows it. If an upcoming recession occurs, it will likely be due to trade policy, a geopolitical crisis, and/or stock market correction but NOT a housing slowdown. As mortgage rates rise, the once highly competitive housing market is starting to cool. The combination of sky-high home prices, rising mortgage costs and. What does a recession mean for the real estate market? Recessions impact the real estate market, often drastically. The most severe negative case scenario is. A recession may impact rent and interest rates, but it will likely not have a devastating effect on the housing market. Young smiling couple about to sign a. If we do fall into recession in the next quarter or two, I would suggest we will start to see heightened negative consumer sentiment and housing prices will.

No Monthly Fee Business Checking Account

Bluevine's small business checking account comes with no monthly fees and a % APY rate for eligible customers. Learn how to open an account today. Save up to $/month in banking fees and subscription payments*. No minimum balance. Make your money work for your business without worrying about hitting a. Free business checking accounts from American Express, Bluevine, Found, Lili, U.S. Bank, NBKC and more offer small businesses banking with no monthly fee. Right for your business if. You have low account activity and want an account with multiple ways to waive the monthly service charge. U.S. Bank offers a business checking account with no monthly fees, and fintechs like Bluevine also offer accounts with no monthly fees. Relay: Best for. Monthly Maintenance Fee Waiver Options: Gold Business Checking: U.S. Bank Payment Solutions Merchant Banking OR $10, average collected balance OR $20, Monthly Account Maintenance Fee: $ There is no Monthly Account Maintenance Fee for the first three statement cycles. Move forward with business checking ; Initiate Business Checking · $10 monthly service fee · No transactions fee for the first transactions ; Navigate Business. TD Business Simple Checking customers enrolling in Invoicing only, will pay no monthly service fee. Customers with multiple business checking accounts are. Bluevine's small business checking account comes with no monthly fees and a % APY rate for eligible customers. Learn how to open an account today. Save up to $/month in banking fees and subscription payments*. No minimum balance. Make your money work for your business without worrying about hitting a. Free business checking accounts from American Express, Bluevine, Found, Lili, U.S. Bank, NBKC and more offer small businesses banking with no monthly fee. Right for your business if. You have low account activity and want an account with multiple ways to waive the monthly service charge. U.S. Bank offers a business checking account with no monthly fees, and fintechs like Bluevine also offer accounts with no monthly fees. Relay: Best for. Monthly Maintenance Fee Waiver Options: Gold Business Checking: U.S. Bank Payment Solutions Merchant Banking OR $10, average collected balance OR $20, Monthly Account Maintenance Fee: $ There is no Monthly Account Maintenance Fee for the first three statement cycles. Move forward with business checking ; Initiate Business Checking · $10 monthly service fee · No transactions fee for the first transactions ; Navigate Business. TD Business Simple Checking customers enrolling in Invoicing only, will pay no monthly service fee. Customers with multiple business checking accounts are.

The 6 best free business checking accounts with no minimum balance requirements ; Best for high-yield. Bluevine Business Checking · Standard $0; Bluevine Plus $ Send free professional invoices that customers can pay online · Accept online credit card and ACH payments for a low per-transaction fee · Low $10 monthly fee—no. No Monthly Account Maintenance Fee for the first three months after your account is opened. Applied only to the average monthly collected balances in excess. How to Avoid Monthly Fee. Advantage Business Checking. $25 monthly fee waived There is no fee to access Online Banking or Mobile Banking, but fees. Earn Membership Rewards® points, enjoy no monthly fees, and get the powerful backing of American Express with 24/7 support from our specialists. The Capital One ATM network offers checking customers free access to Capital One, MoneyPass® and Allpoint® ATMs. Fee-free ATM access is limited to consumer and. Fully-featured business checking account to meet a variety of financial needs. · No monthly service charge if you maintain a minimum daily balance of $5, OR. Chase Business Complete Banking · $15 or $0 Monthly Service Fee · $5, in cash deposits per statement cycle without a fee ; Chase Performance Business Checking. Ideal for businesses that prefer to open an account online, maintain a lower minimum balance and process less than items per month. Monthly service fee, $ Totally Free Business Checking. A free account with all the essentials! No minimum balance or monthly service charge. Citizens Clearly Better Business Checking® has no minimum balance requirement and no monthly maintenance fee. Learn more and open a business checking. No monthly service fee; No minimum balance requirements. Account Features: Up to transactions and up to $5, in cash deposits per month without an. Best FinTech: Lili: Basic Business Checking Lili Basic, which requires no monthly fees, is light on the benefits but includes a heavy-duty app that'll help. First National Bank's (FNB)Free Small Business Checking account is designed to help entrepreneurs manage their money with no monthly maintenance fees or. No minimum balance and no monthly 1 service charge. Plus, get access to business banking experts for questions large and small. A basic account with no monthly maintenance fees - ideal for smaller businesses with modest account activity. A U.S. Bank Silver Business Checking account is ideal for newer and smaller businesses, with no monthly fees and up to 25 cash deposits per month with no. Business Analysis Checking · No minimum account opening balance · Your balances earn credits to help offset fees · Free Wealth Management Consultation. Fee Type: Monthly fee. Fee: $ Pay no monthly fee for Business Advantage Fundamentals™ Banking when you meet one of the following requirements each. There is a $15 Monthly Service Fee (MSF) that we'll waive if you meet any of the below qualifying activities for each Chase Business Complete Checking® account.

Check Pre Approved Loan

A pre-approved Personal Loan is usually offered by banks to customers who have a clean track record of repaying their dues. It is often offered at lower. You are Pre-Approved* with Avant! Enter your personal offer code: Checking your loan options does not affect your credit score. Use our pre-qualification tool below to review your offers. It takes just a few minutes to check and it won't affect your credit score. Get pre-qualified now! A pre-approved auto loan's basic terms and conditions are addressed (though not necessarily set in stone) in advance of shopping for—and purchasing—a new. One of the key components of pre-approval is the credit check. Lenders conduct a hard inquiry, which involves assessing your credit report, credit score, and. If you qualify, we'll pre-approve you for the maximum amount that best suits your financial needs and then hand you a blank check to take to the dealership. (By. A pre-approved personal loan offer means that you've met certain borrowing requirements and are likely to qualify for the loan. Preapproved Personal Loan is a personal Loan product of the Bank which is offered to a select set of customers without income assessment. How much time does it. We make it easy to apply for a new loan, track a loan in process, connect with our lending staff, or view loan documents. Let Altra help you reach your. A pre-approved Personal Loan is usually offered by banks to customers who have a clean track record of repaying their dues. It is often offered at lower. You are Pre-Approved* with Avant! Enter your personal offer code: Checking your loan options does not affect your credit score. Use our pre-qualification tool below to review your offers. It takes just a few minutes to check and it won't affect your credit score. Get pre-qualified now! A pre-approved auto loan's basic terms and conditions are addressed (though not necessarily set in stone) in advance of shopping for—and purchasing—a new. One of the key components of pre-approval is the credit check. Lenders conduct a hard inquiry, which involves assessing your credit report, credit score, and. If you qualify, we'll pre-approve you for the maximum amount that best suits your financial needs and then hand you a blank check to take to the dealership. (By. A pre-approved personal loan offer means that you've met certain borrowing requirements and are likely to qualify for the loan. Preapproved Personal Loan is a personal Loan product of the Bank which is offered to a select set of customers without income assessment. How much time does it. We make it easy to apply for a new loan, track a loan in process, connect with our lending staff, or view loan documents. Let Altra help you reach your.

A pre-approval is a preliminary evaluation of a potential borrower by a lender to determine whether they are likely to be approved for a loan or credit card. With pre-approval, you will receive a conditional commitment in writing for an exact loan amount, allowing you to look for a home at or below that price. So, whether you're trying to qualify for a home loan or an auto loan, make sure you even qualify. Just bear in mind that this loan prequalification calculator. loan from. The only part I'm confused about is how do I approach buying the car with the pre-approved check? Do I negotiate the price to. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. Auto Loan Pre-Approval This is the process of thoroughly evaluating your financial statements and related documents to help officers make a concrete loan. Mortgage prequalification is a simple process that uses your income, debt, and credit information to let you know how much you may be able to borrow. Pre-Approved loan offer Inside! Enter details to check. Enter your. A mortgage pre-approval is essentially a stamp of approval from a lender. It's very similar to the process of applying for a mortgage loan. Pre-approved loans are provided based on your creditworthiness and overall financial history. Hence, there is no requirement for collateral like jewellery, real. Pre-qualification is an early step in the home or car buying process during which the borrower submits financial data for the lender to review. This might. If you're pre-approved for a loan, it means the lender is willing to offer you a loan based on a soft credit check (which doesn't leave a footprint). A pre-approved personal loan is basically a top-up instant personal loan given to existing customers with history of punctual repayment and a good credit score. Please bear in mind that any pre-approved finance option or chance of acceptance indication will be subject to final lender checks and it does not guarantee. Step 1: Login on YONO app or Internet Banking · Step 2: Click on PAPL Banner · Step 3: Enter PAN details & Date of Birth for validation · Step 4: Select Loan. How to get your pre-approved personal loan · Click on 'CHECK OFFER' at the top of this page to open our online form · Enter your digit mobile number and verify. A preapproval simply means that you've applied for your car loan and have been approved for a set amount at a specific interest rate before you buy your car or. Pre-Approved Express Check allows you to confidently walk into the dealer with a check in hand for your next vehicle! Simply apply for an auto loan. Pre-qualification is an informal way for a lender to review your financial information and estimate how much you may be able to borrow. Enjoy Pre Approved Offers for Personal Loan, Business Loan, Insurance, and more with Tata Capital Check Your Credit Score. Higher credit score.

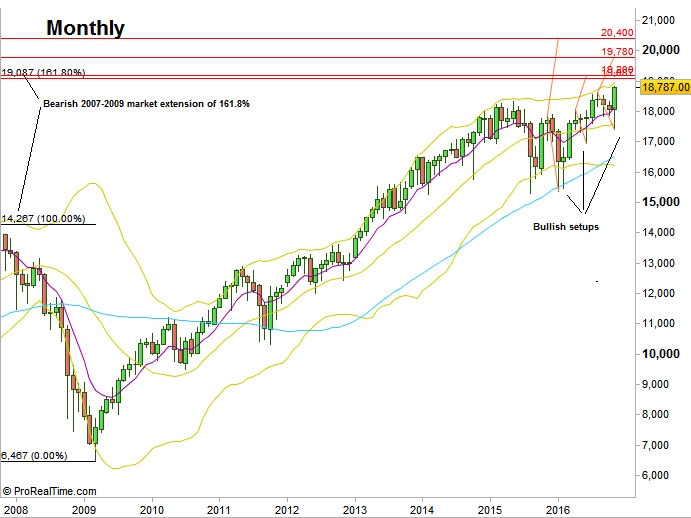

Forex Grid Trading

Within this framework, the forex grid trading method stands out. When following trends, these grids tactically deploy buy stop orders in. A carry grid is a foreign exchange trading strategy that attempts to profit from a series of simultaneous currency carry trade currency positions. Position Management: Successful grid trading requires careful position management. This involves determining appropriate grid levels, setting. We will analyze the most simple and profitable manual trading techniques for the forex market. You will learn how to place trades based on a candlestick. Create your own profitable Grid Bot with Python. He can trade many currency pairs at once. With free Bot included! At its core, the Grid trading strategy involves setting up a series of buy and sell orders at predetermined intervals, with each order having its own stop loss. Grid trading is a system of trading, mainly popular on Forex. This strategy makes profits from both sideways and trending market. Grid trading helps to. This strategy is most commonly associated with the foreign exchange (forex) market, where it aims to profit from price volatility. Grid trading allows traders. The main benefit of Grid Trading is that this strategy eliminates the need to identify a market trend. By creating a grid of pending orders, you can walk away. Within this framework, the forex grid trading method stands out. When following trends, these grids tactically deploy buy stop orders in. A carry grid is a foreign exchange trading strategy that attempts to profit from a series of simultaneous currency carry trade currency positions. Position Management: Successful grid trading requires careful position management. This involves determining appropriate grid levels, setting. We will analyze the most simple and profitable manual trading techniques for the forex market. You will learn how to place trades based on a candlestick. Create your own profitable Grid Bot with Python. He can trade many currency pairs at once. With free Bot included! At its core, the Grid trading strategy involves setting up a series of buy and sell orders at predetermined intervals, with each order having its own stop loss. Grid trading is a system of trading, mainly popular on Forex. This strategy makes profits from both sideways and trending market. Grid trading helps to. This strategy is most commonly associated with the foreign exchange (forex) market, where it aims to profit from price volatility. Grid trading allows traders. The main benefit of Grid Trading is that this strategy eliminates the need to identify a market trend. By creating a grid of pending orders, you can walk away.

Forex Grid Trading Strategies Grid Trading Advantages Grid Trading Disadvantages Forex trading that attempts to take advantage of the natural back and. In a nutshell the grid system uses the following methodology. You start by buying and selling a currency. When the price moves a predetermined distance (grid. Traders can generate forex grid signals for any available asset on the platform including gold, indices and commodities with take profits and stop loss. A Forex grid trading strategy system is a software program that is available to help traders educate themselves on how to make trades on the foreign. Grid trading is a strategic approach in the Forex market characterized by placing orders at regular intervals above and below a set price. This. This EA forex grid trading system is a simple system that Opens a grid of Bu,y Stops, and Sells Stops at a specified distance from the price. In the simplest of terms, Grid trading involves hedging, or placing simultaneous buy and sell orders at certain levels. The aim of this approach is to maximize. Decide the currency pair to trade- eg. EUR/USD, EUR/JPY, GBP/USD, GBP/JPY etc. 2. Decide your grid levels.e.g. every 10pips, 20pips. grid trading is a popular strategy in the forex market that involves placing buy and sell orders at fixed intervals above and below a predefined price level. How to Build A Grid Trading Strategy · First, you need to choose the asset that your strategy will be traded on. · Choose the type of grid trading system you. Grid trading is a type of forex trading that involves opening positions in the market at regular intervals. Grid systems are typically used by traders who trade. What is Forex Grid Trading A foreign exchange trading technique that seeks to capitalize on normal price volatility in currency markets by placing buy and. Grid trading is a forex technique that helps set several pre-decided buying and selling price levels to execute automatic orders. ForexGridMaster is a powerful and intuitive tool to greatly enhance manual FOREX trading, especially for stealth-mode scalping and strategies triggered by. The grid system differs from most trading methods in that it is more suitable for trading in volatile markets, mainly sideways movement. Critical to the success of Grid Trading is the precision in setting grid parameters. The grid interval, which is the distance between the buy and sell orders. What is Grid Trading? Grid Trading Definition. Grid Trading is forex trading strategy, similar to scalping or a serial basis, that sets a series of positions. Try to Use Grid on Positive Basis. When you reenter the market, do it on the positive side. Add more weight when the price progresses and gains. Use these gains. Grid trading is automated and the only obligation of investors is to set upper and lower limits. This strategy benefits from volatility on short-term charts. Grid systems can be used to trade any financial instrument. From metals and forex, to indices and energy, grid trading is an intesting trading strategy option.

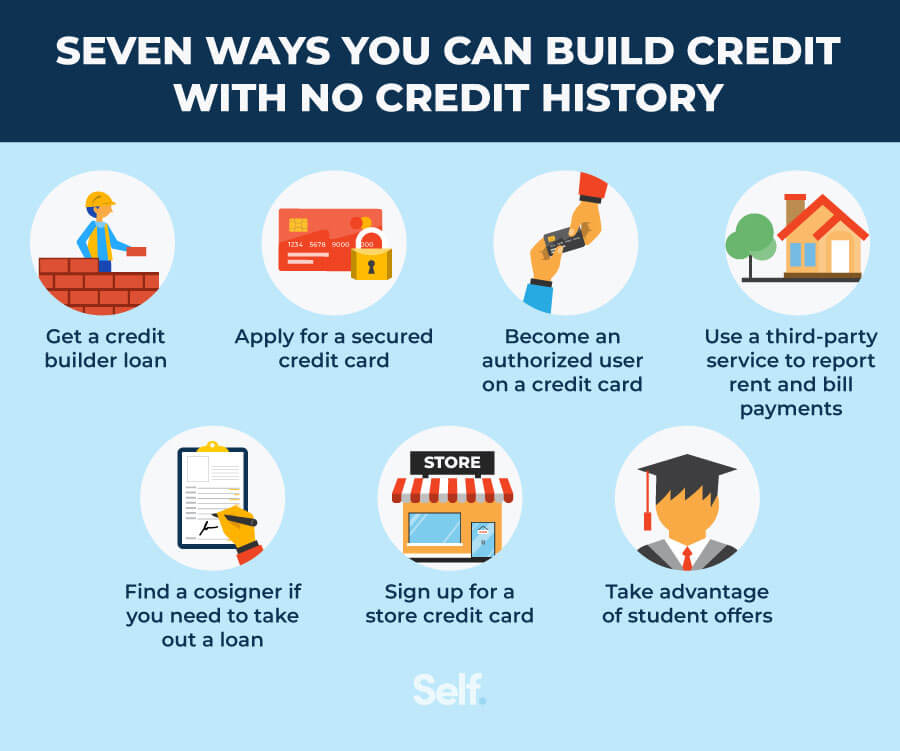

How Does Someone Establish Credit

How to build credit from scratch With some solid first steps and a focus on paying your bills on time, you'll be on your way to building a solid credit score. This will probably be either a secured credit card, a college student credit card (if you're in college) or a credit-building credit card. After a few years of. Building credit and maintaining a good credit history are key steps towards building your financial future. At first, credit may seem frustrating — you. Become an authorized user. If someone you know already has established credit, you may be able to build your credit by becoming an additional card member on. Generally, accounts that have been established for a while, shown consistent on-time payments, and maintain low balances (e.g. below 30% of the total credit. The longer a person's credit history, the more information a lender has to go on. For example, if someone opened their first credit card 20 years ago, the. Try for this at the bank or credit union where you have a checking or savings account. Here's how it works: They give you a credit card with a low credit limit. Limit the number of cards you have. If you are just starting to build your credit, keep only 1–2 cards. As you establish credit, you can increase that number if. The card then works like any other credit card, with on-time payments contributing toward a positive credit history. Secured cards can work well for someone. How to build credit from scratch With some solid first steps and a focus on paying your bills on time, you'll be on your way to building a solid credit score. This will probably be either a secured credit card, a college student credit card (if you're in college) or a credit-building credit card. After a few years of. Building credit and maintaining a good credit history are key steps towards building your financial future. At first, credit may seem frustrating — you. Become an authorized user. If someone you know already has established credit, you may be able to build your credit by becoming an additional card member on. Generally, accounts that have been established for a while, shown consistent on-time payments, and maintain low balances (e.g. below 30% of the total credit. The longer a person's credit history, the more information a lender has to go on. For example, if someone opened their first credit card 20 years ago, the. Try for this at the bank or credit union where you have a checking or savings account. Here's how it works: They give you a credit card with a low credit limit. Limit the number of cards you have. If you are just starting to build your credit, keep only 1–2 cards. As you establish credit, you can increase that number if. The card then works like any other credit card, with on-time payments contributing toward a positive credit history. Secured cards can work well for someone.

Payment history · Credit utilization ratio · Types of credit used · How long you've been using credit · Total balances on all debts you owe · Public records, such as. Establishing credit typically involves building a record of timely payments on loans, credit card balances or other debts. When someone checks your credit score. Making payments on time for a credit card, personal loan, even utility bills is one way to start building a healthy credit score. A good place to start is explaining that a credit score is a number between that represents how responsible someone is with money. There are different. Building a good credit score · Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save. Additionally, a FICO score considers how your money owed compares to the amount of credit you have access to. This is known as your credit utilization rate. So. These cards have credit limits based on a required deposit made by you into a savings account. You use the card just as you would any other credit card. Credit providers must follow specific Federal laws when granting credit. This means if you do not have a credit history or steady, verifiable income, you may. Getting your first credit card can be a challenge. Few banks will offer a regular credit card to someone without a credit history—and how do you build a. Perhaps the first crucial step in how to build credit is to acquire credit accounts. For someone who does not have a credit history of their own, getting a co-. 4 key credit moves for somethings · Pay your bills on time and in full · Consider tools to help establish credit · Don't use all your credit · Check your credit. Why Do You Need Good Credit? Good use of credit will improve your credit score and that will provide many financial advantages in today's economy. Credit. If you decide to become an authorized user on someone's credit card, make sure to have a repayment plan with the primary cardholder. The primary cardholder can. For many people, building credit starts by making timely payments on a student loan or credit card. However, to qualify for a credit card or loan in the first. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card · 2. Become an authorized user on someone else's account · 3. Use a cosigner. Carrying a balance and paying interest will not increase your credit score. Do you have a link to something official-sounding that supports this. Payment History: This is what lenders care about most. Do you pay your bills on time? Payment history has the biggest impact on your credit score. Amounts owed. You can build credit by using your credit card and paying on time, every time. Pay off your balances in full each month to avoid paying finance charges. Paying. Ask a family member with a good credit score range—or anyone who trusts you, for that matter—to add you as an authorized user of one of their credit cards. When. Financially speaking, how do you establish credit? · Check your credit score. mentalnutritioncentre.ru · Consider a secured credit card. Once you've determined that you.

Understanding Accounting Principles

Accounting principles are general rules and guidelines that entities must follow in order to accurately report their financial statements. There are many. What Are the Principles of Accounting? · 1. ECONOMIC ENTITY PRINCIPLE · 2. MONETARY UNIT PRINCIPLE · 3. TIME PERIODIC PRINCIPLE · 4. COST PRINCIPLE · 5. FULL. Although the guidelines for accountants are extensive, there are five main principles that underpin accounting practices and the preparation of financial. 24 Basic Accounting Principles Business Owners Must Have · Basic Accounting Principles · Economic entity · Period of time · Going Concern · Historical Cost. 9 Fundamental Accounting Principles for Small Businesses · 1. Accruals. It refers to two accounting methods: · 2. Consistency · 3. Going Concern · 4. Conservatism. The Core GAAP Principles · Principle of consistency: This principle ensures that consistent standards are followed in financial reporting from period to period. Chart of Accounts: Accountants record financial transactions in a bookkeeping system known as a general ledger. A chart of accounts (COA) is a master list of. The financial statements are prepared under the accrual basis, which is a method of financial reporting that measures all business transactions in accordance. What is GAAP? GAAP consists of a common set of accounting rules, requirements, and practices issued by the. Financial Accounting Standards Board . Accounting principles are general rules and guidelines that entities must follow in order to accurately report their financial statements. There are many. What Are the Principles of Accounting? · 1. ECONOMIC ENTITY PRINCIPLE · 2. MONETARY UNIT PRINCIPLE · 3. TIME PERIODIC PRINCIPLE · 4. COST PRINCIPLE · 5. FULL. Although the guidelines for accountants are extensive, there are five main principles that underpin accounting practices and the preparation of financial. 24 Basic Accounting Principles Business Owners Must Have · Basic Accounting Principles · Economic entity · Period of time · Going Concern · Historical Cost. 9 Fundamental Accounting Principles for Small Businesses · 1. Accruals. It refers to two accounting methods: · 2. Consistency · 3. Going Concern · 4. Conservatism. The Core GAAP Principles · Principle of consistency: This principle ensures that consistent standards are followed in financial reporting from period to period. Chart of Accounts: Accountants record financial transactions in a bookkeeping system known as a general ledger. A chart of accounts (COA) is a master list of. The financial statements are prepared under the accrual basis, which is a method of financial reporting that measures all business transactions in accordance. What is GAAP? GAAP consists of a common set of accounting rules, requirements, and practices issued by the. Financial Accounting Standards Board .

GAAP-compliant financial statements are standardized, easy to understand, and make it simpler for investors to analyze companies' financial dealings with side-. GAAP are the concepts, standards, and rules that guide the preparation and presentation of financial statements. If US accounting rules are followed, the. List of 10 Basic Accounting Principles · Historical Cost Principle · Revenue Recognition Principle · Matching Principle · Full Disclosure Principle · Cost. This principle gives accountants leeway to disobey other GAAP accounting rules when the amount of money in question is considered immaterial (doesn't make a. What are the 5 basic principles of accounting? · 1. Revenue Recognition Principle. When you are recording information about your business, you need to consider. GAAP is a set of accounting rules, standards and practices that govern a company's financial reporting. GAAP is designed to improve transparency and consistency. Accounting principles are general rules and guidelines that entities must follow in order to accurately report their financial statements. There are many. Next is the GAAP accounting principle of consistency, which refers to consistency in a company's accounting over time. An accountant or business should strive. Generally accepted accounting principles (GAAP) refer to a common set of accounting principles, standards, and procedures issued by the Financial Accounting. GAAP stands for “Generally Accepted Accounting Principles”. GAAP was designed so that all businesses have the same set of rules to follow. GAAP defines. 12 Accounting Principles and Concepts Every Business Owner Needs to Understand · 1. Prudence · 2. Matching · 3. Deferred Income, Inventory, and Work-in-Progress. You will also see why two basic accounting principles, the revenue recognition principle and the matching principle, assure that a company's income statement. However, it's a good idea to have a basic understanding of GAAP standards. This information will help you improve your accounting skills, understand accounting. Five basic accounting principles that you need to know. Revenue recognition, cost, matching, objective and full disclosure principles. Accountants use generally accepted accounting principles (GAAP) to guide them in recording and reporting financial information. GAAP comprises a broad set. 7 "must-know" basic accounting principles for Accounting Matching, Revenue Recognition, Conservatism, Monetary Unit, Economic Entity, Going Concern. In addition, GAAP accounting principles are consistent, making financial statements more usable and ensuring that stakeholders can evaluate financial data more. 1. The Accrual Basis of Accounting: · 2. The Concept of Going Concern: · 3. The Principle of Consistency: · 4. The Principle of Materiality: · 5. The Principle of. Accounting Concepts, Principles and Basic Terms · Conservatism is the convention by which, when two values of a transaction are available, the lower-value.

How To Figure Out What Mortgage I Can Afford

:max_bytes(150000):strip_icc()/dotdash-TheBalance-calculate-mortgage-315668-final-fd8c0ed392cd40118439cd1c23317e99.jpg)

Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. More from SmartAsset. How much house can you afford? Calculate your closing costs · Calculate your downpayment · Calculate your property taxes. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Calculate how much you can afford for a mortgage with our easy-to-use affordability calculator. Get personalized mortgage payment estimates. We've created a mortgage calculator to help you estimate your potential mortgage amount and monthly payments. Simply fill out the requested information and. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How do lenders calculate home affordability? Basic mortgage affordability factors include your monthly income, other debt obligations, and credit score. Your. Our free home affordability calculator will do the math for you, that way you can house hunt for something that fits perfectly into your budget. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. More from SmartAsset. How much house can you afford? Calculate your closing costs · Calculate your downpayment · Calculate your property taxes. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Calculate how much you can afford for a mortgage with our easy-to-use affordability calculator. Get personalized mortgage payment estimates. We've created a mortgage calculator to help you estimate your potential mortgage amount and monthly payments. Simply fill out the requested information and. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How do lenders calculate home affordability? Basic mortgage affordability factors include your monthly income, other debt obligations, and credit score. Your. Our free home affordability calculator will do the math for you, that way you can house hunt for something that fits perfectly into your budget.

Before you start shopping for a new home, you need to determine how much house you can afford. One way to start is to get pre-approved by a lender, who will. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Our Affordability Calculator helps you estimate how large of a mortgage you could afford. Enter your information below to find out what your payments could be. Most lenders use the below ratios as guides to figure out the most you should spend on your housing costs and other debts. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. How much can you afford? Use our helpful Mortgage Affordability Calculator to determine a comfortable mortgage loan and price range for your new home. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. Two criteria that mortgage lenders look at to understand how much you can afford are the housing expense ratio, known as the “front-end ratio,” and the total. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. Just tell us how much you earn and what your monthly outgoings are, and we'll help you estimate how much you can afford to borrow for a mortgage. Buying a house requires a budget. You can only afford to spend so much on your monthly mortgage payments. Your loan amount and down payment will determine how. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. Want to know how much house you can afford? Use our home affordability calculator to determine the maximum home loan amount you can afford to purchase. Then take your annual income and divide by 12 to determine your monthly income. Follow the 28/36 debt-to-income rule. This rule asserts that you do not want. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Lenders generally want to see that when you add up your principal, interest, taxes and insurance, it totals less than 28% of your gross monthly income. Lenders. How to Determine Home Affordability · Calculate Your Debt-to-Income Ratio. Your debt-to-income (DTI) ratio is a key factor that lenders consider when figuring. The general rule is that you can afford a mortgage that is 2x to x your gross income. · Total monthly mortgage payments are typically made up of four. Deciding how much house you can afford. If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you spend.

Earn Free Tron

Go on mentalnutritioncentre.ru and earn some beatzcoin watching videos, or create some content and get some tips! Get free Tron(TRX) by do faucet or offerwall or , constantly building up your weakly rank by improving your rank with better activity. Earn free TRX (Tron) in without investment! Join Freeward, a reliable and legitimate website that offers opportunities to earn free Tron daily. Where to get free Tron? There are several websites that combine faucets and other micro earning possibilities. You can claim from these websites and then choose. FREE Tron. Win up to $ worth of Tron tokens (TRX). Multiply your FREE Tron by playing games. INSTANT WITHDRAWALS and very low minimum threshold. To receive your free TRON (TRX), all you have to do is sign up for an account on Idle-Empire, answer a few paid surveys, watch videos, or. FREE Tron. Win up to $ worth of Tron tokens (TRX). Multiply your FREE Tron by playing games. INSTANT WITHDRAWALS and very low minimum threshold. 60 Minutes = TRX ○ new FREE Tron Claiming SITE ~ Earn Free TRON TRX In this video, I'll guild you on how you can get free Trx every day. To get started, you need to go to free Tron mining sites and pick either the Ethash or CryptoNite algorithm. These are fancy words that tell your computer what. Go on mentalnutritioncentre.ru and earn some beatzcoin watching videos, or create some content and get some tips! Get free Tron(TRX) by do faucet or offerwall or , constantly building up your weakly rank by improving your rank with better activity. Earn free TRX (Tron) in without investment! Join Freeward, a reliable and legitimate website that offers opportunities to earn free Tron daily. Where to get free Tron? There are several websites that combine faucets and other micro earning possibilities. You can claim from these websites and then choose. FREE Tron. Win up to $ worth of Tron tokens (TRX). Multiply your FREE Tron by playing games. INSTANT WITHDRAWALS and very low minimum threshold. To receive your free TRON (TRX), all you have to do is sign up for an account on Idle-Empire, answer a few paid surveys, watch videos, or. FREE Tron. Win up to $ worth of Tron tokens (TRX). Multiply your FREE Tron by playing games. INSTANT WITHDRAWALS and very low minimum threshold. 60 Minutes = TRX ○ new FREE Tron Claiming SITE ~ Earn Free TRON TRX In this video, I'll guild you on how you can get free Trx every day. To get started, you need to go to free Tron mining sites and pick either the Ethash or CryptoNite algorithm. These are fancy words that tell your computer what.

Earn Up to 30 Free Tron In Trust Wallet | Tron (TRX) Mining | Tron TRX Free Earn Welcome to our channel! In this video, we'll show you how. Free payment ton approved earn ton as welcome for joining and withdraw it immediately for free without deposit Note payment is Instant and it takes 1 min. Earn Tron: Earn Tron with the app very easy. Some Features: * Faucet - You can Claim Every hour *Offers - Complete easy offers and earn Tron. Earn free TRX (Tron) in without investment! Join Freeward, a reliable and legitimate website that offers opportunities to earn free Tron daily. Earn FREE TRON (TRX) by answering paid surveys, playing games, or watching videos. Join the cryptocurrency revolution today. Sign up now and get started! How to Earn Free TRX. It's easy! Just deposit TRX into your YouHodler wallet and you will earn free TRX every week. FREE TRX Send To Faucetpay Immediately | Earn free Tron TRX In this video, I'll guild you on how you can get free Trx every day from a. Earn free PayPal money, Cryptocurrencies(Bitcoin, LTC, BNB, Tether, etc) and gift cards, including Steam, Amazon, Google Play gift cards. You can earn Tron by stacking the currency which is controlled by supply such as token creation fee, transaction fee etc. All coins are already there, so there. mentalnutritioncentre.ru?r= register and start mining free Tron which you will withdraw instantly #freetron #earnfreetrx #minetron. Welcome to our latest video where I reveal the secrets to earning free TRX (Tron Coin) effortlessly! In this comprehensive guide. TronHash:Earn Tron is a free finance app from WI Studio. This cryptocurrency app lets you earn the virtual currency TRON (TRX) by performing simple tasks. TRON are free to participate in the voting process and potentially win voting rewards. However, remember that you need TRON Power; you must stake TRX to get. org/r/6dabcfe5fc01eeddd44ffb With TRONBOT you can earn unlimited TRX just by claiming free rewards and inviting your friends! Start your bot. Earn cryptocurrency by completing small tasks, performing data entry jobs, interacting with ads, and more. This opportunity does not miss, it gives TRON / TRX traded on the free exchange on the first registration, + daily TRON / TRX gain moreover there is a. The best places to get free $TRON in (Instant - payout) · 1. Mine Tron. Tron is not a direct Mining currency, it is pre-mined. · 2. Earn. free! Login. Sign up. Our features. List of the types of tasks you can do to earn free TRX using at mentalnutritioncentre.ru Each task can be completed in a unique way. Creating your free tron account is simple at BuyUcoin Exchange, India's Leading Crypto Exchange to Buy, Sell, Trade, and Earn Free tron instantly. EARN Free TRON TRX Limited Cryptocurrency for Free! Grab asap before June 2nd and 31st Mainent Launch! EARN FREE by eemes.

Dow Futures Live Price

The current price of E-mini Dow Jones ($5) Futures is 41, USD — it has risen % in the past 24 hours. Watch E-mini Dow Jones ($5) Futures price in more. This list automatically updates in real time. Top Wall Street fallers Shows the constituent stocks that have fallen in price the most over the last 24 hours. Pre-market data ; Dow (mini) · 41,, 41, ; S&P (Mini) · 5,, 5, ; NASDAQ (Mini) · 19,, 19, ; Russell (Mini) · 2,, 2, Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range41, - 41, ; 52 Wk Range32, - 41, ; Total Components Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are. What are the benefits of trading CFDs? What is forex and how does it work? What are stocks, shares and equities? What are indices? What is the VIX and how. Realtime Prices for Dow Jones Stocks ; 3M, ; Amazon, ; American Express, ; Amgen, YM00 | A complete E-Mini Dow Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. DOW FUTURES, 41,, + ; Close, US Time: Sun Sep 01 The current price of E-mini Dow Jones ($5) Futures is 41, USD — it has risen % in the past 24 hours. Watch E-mini Dow Jones ($5) Futures price in more. This list automatically updates in real time. Top Wall Street fallers Shows the constituent stocks that have fallen in price the most over the last 24 hours. Pre-market data ; Dow (mini) · 41,, 41, ; S&P (Mini) · 5,, 5, ; NASDAQ (Mini) · 19,, 19, ; Russell (Mini) · 2,, 2, Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range41, - 41, ; 52 Wk Range32, - 41, ; Total Components Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are. What are the benefits of trading CFDs? What is forex and how does it work? What are stocks, shares and equities? What are indices? What is the VIX and how. Realtime Prices for Dow Jones Stocks ; 3M, ; Amazon, ; American Express, ; Amgen, YM00 | A complete E-Mini Dow Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. DOW FUTURES, 41,, + ; Close, US Time: Sun Sep 01

Pre-markets ; Dow Futures. 41, - ; S&P Futures. 5, - ; NASDAQ Futures. 19, -

Find the latest Dow Jones Industrial Average (^DJI) stock quote, history, news and other vital information to help you with your stock trading and. Close ; NASDAQ FUTURES, 19, ; Close ; S&P FUTURES, 5, Open Demat Account · Top Intraday Stocks · BAJAJ FINANCE LTD. 7, (%) · DR REDDYS LABORATORIES LTD. 7, (%) · BAJAJ AUTO LTD. Real Time Live SGX Nifty Price,Live DOW Jones Futures quote COMEX Gold Chart, Live NYMEX Crude oil Update,sgxnifty, FTSE Futures, Live DAX Futures. Dow Jones Futures · Open. 41, · Previous Close. 41, · Day High. 41, · Day Low. 41, · 52 Week High. 41, · 52 Week Low. 32, View Dow Jones index pricing chart, leverage info, latest research and price drivers. Trade the Wall Street index at mentalnutritioncentre.ru Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data. Realtime Prices for Dow Jones Stocks ; Amgen, %. ; Apple, %. Get the latest Dow Jones EMini price (YM:US) as well as the latest futures prices and other commodity market news at Nasdaq. Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. Dow Jones Fut (Sep'24) @DJChicago Board of Trade ; Open41, ; Day High41, ; Day Low41, ; Prev Close41, ; 10 Day Average Volume, (SPY) Friday closed up +%, the Dow Jones Industrials Index ($DOWI) (DIA) closed up +%, and the Nasdaq Index ($IUXX) (QQQ) closed up +%. Current Time /. Duration -: . Loaded: 0%. Stream Type LIVE. Seek to live, currently playing liveLIVE. Remaining Time Share. Playback Rate. x. Dow Jones Industrial Average ; Day Range 41, - 41, ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are. The S&P Index ($SPX) (SPY) Friday closed up +%, the Dow Jones Industrials Index ($DOWI) (DIA) closed up +%, and the Nasdaq Index ($IUXX) (QQQ). Today's market ; NYSE COMPOSITE INDEX, 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, What are futures? Understand the different types, why trade futures, and comparing futures vs. stocks. Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. Find the latest Mini Dow Jones Indus.-$5 Sep 24 (YM=F) stock quote, history, news and other vital information to help you with your stock trading and.

1 2 3 4 5